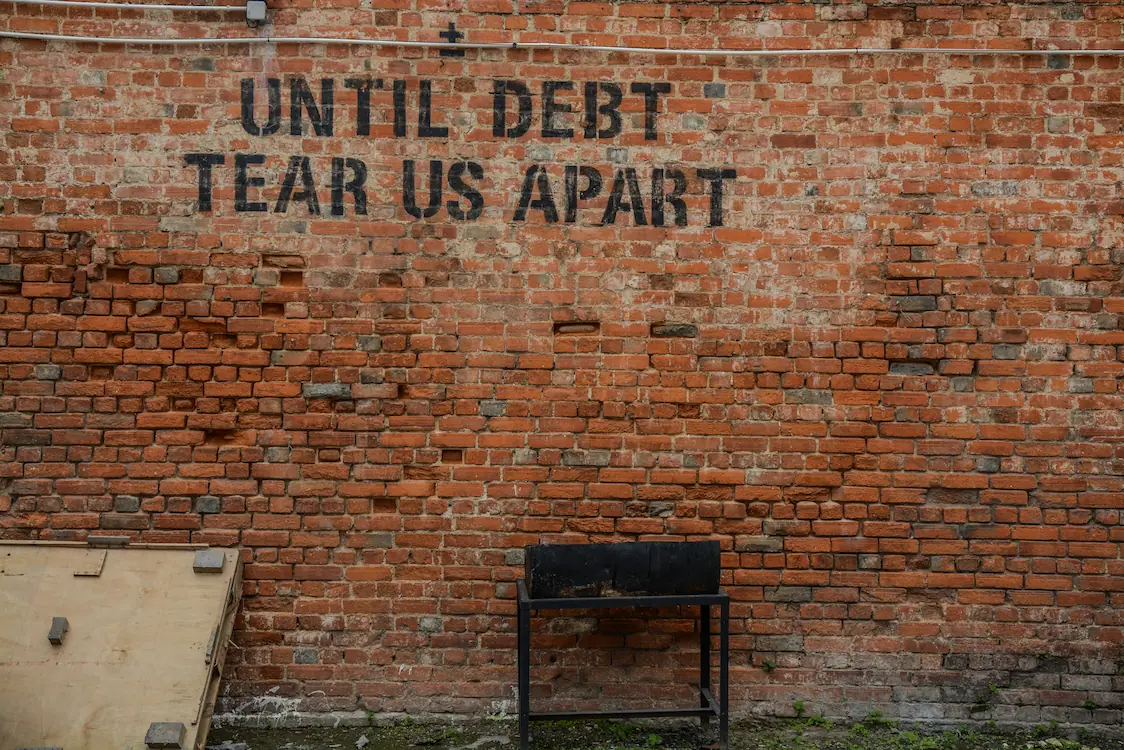

Reduce your debts

IF YOU HAVE a large debt or several debts it can feel like pushing a rock up a hill trying to pay them off.

However, the team at MoneyTalks have some great tips to reduce those debts and to get rid of them.

The first action to take if you’re struggling to pay your debt is contact the lender and see if you can re-negotiate the debt payments.

If there is no give from the lender you will probably need some support and a free financial mentor can help at this stage. When you contact the MoneyTalks team, explain what your situation is, what kind of loan or loans you have, and the amount of debt you're carrying. You can find a financial mentor on this page or by calling MoneyTalks on the number at the top of this page.

Financial mentors can act on your behalf and have access to staff at banks and lenders who deal with hardship. They can also help you dispute the loan if they feel that it has been lent irresponsibly and lodge a complaint with the respective disputes resolution scheme of the lender.

There are four of these in New Zealand: the Financial Dispute Resolution Service, Financial Services Complaints Ltd, the Banking Ombudsman, and the Insurance and Financial Services Ombudsman Scheme.

Utilities Disputes can assist with issues with power problems and the Telecommunications Disputes Resolution deal with disputes with your phone and/or internet provider.

What if a debt collector becomes involved?

A debt collector will only become involved if you have not been able to meet your loan obligations.

The lender can either ask the debt collection agency to recover the debt for them, or sell the debt to the agency which then legally becomes the “creditor” for the debt and has the same options the creditor had.

Legal action can be taken against you to recover a debt and this will usually be to the Disputes Tribunal where the debt is $30,000 or less. Action can also be taken in the District Court if the debt is not more than $350,000. Any higher than that and it can go to the High Court.

At this stage you will need to seek legal advice, with Community Law a free option.